Published by Malavika Solanki

Several users have reached out with this question in recent weeks, prompting this note. Having discussed the matter with a range of industry experts, it was felt that an analogy from outside financial markets might be the best way to highlight the principle… so here it is.

A helpful way to look at the CFI (Classification of Financial Instrument) code (ISO 10962) is to think of it as a means of determining what something is, in a way that describes some of its primary characteristics.

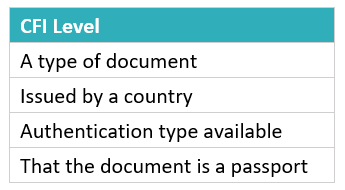

So, using something we are all familiar with, let’s imagine we are talking about personal identification. In this scenario, a CFI might tell you the following:

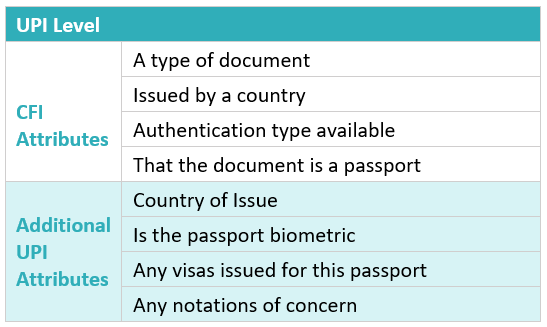

The UPI (Unique Product Identifier – ISO Standard under development) would then tell you some more about the document, such as:

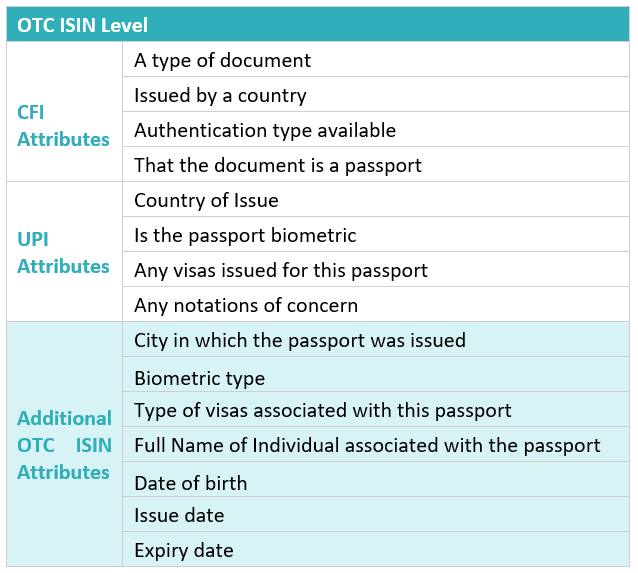

Finally, the OTC ISIN (International Securities Identification Number – ISO 6166) would tell you yet more about the document, such as:

In essence, each level of the data hierarchy offers a differing (more granular) view into the available information set, and can be used to aggregate based on the required level of granularity. The analogy above offers a framework for thinking about how each of the CFI, UPI and OTC ISIN combine to address individual data aggregation requirements.

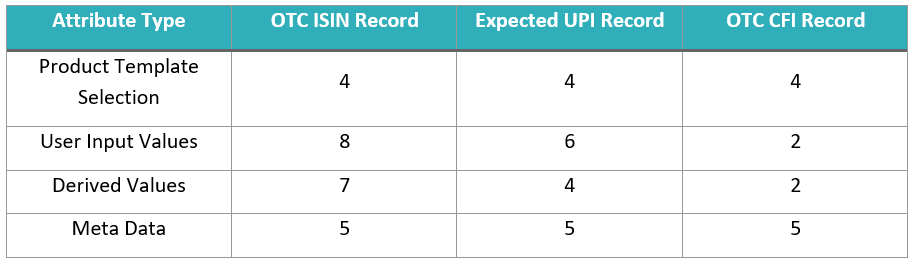

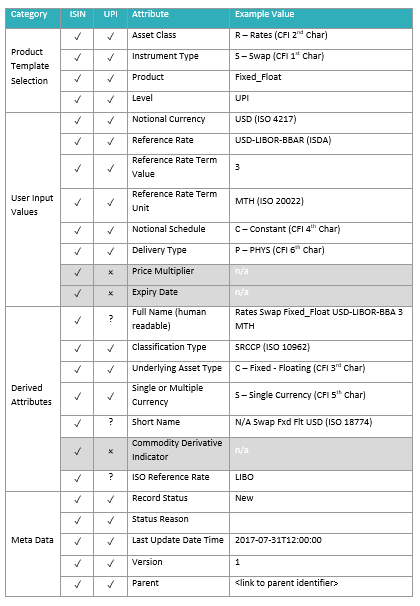

To put the information presented above within the context of the attributes required to define an OTC derivative, an example of the expected OTC ISIN to UPI mapping is presented below. The structure in the tables below is based on the UPI Technical Guidance document published by CPMI-IOSCO in September 2017.

For a single currency fixed-float Interest Rate Swap:

- The OTC ISIN Record is a superset of the UPI Record

- The UPI contains two fewer attributes to uniquely define the Record

- The DSB can derive additional useful information for both regulators and industry

- The DSB Record contains additional meta data that tracks version, status and other administrative information

As a reminder, the DSB offers CFI and OTC ISIN creation and search services today, with UPI services under development and expected to come online in 2022, to dovetail with regulatory expectations published in September 2019.

As ever, questions are welcome and can be directed to otc.data@anna-dsb.com.

— END —