Menu

The Derivatives Service Bureau is a global numbering agency for OTC derivatives serving the needs of market participants through the allocation of International Securities Identification Numbers (ISINs), the Classification of Financial Instruments (CFI) and Financial Instrument Short Name (FISN), all globally recognised and adopted ISO standards for identifying, classifying and describing financial instruments. Serving over 3,100 users spanning 420 institutions, the DSB issued ISINs are now used in at least 33 countries for identifying OTC derivatives.

The Financial Stability Board (FSB) also recently designated the DSB as both the service provider for the future UPI system assigned to an OTC derivatives product and the operator of the UPI reference data library. The UPI will be used for identifying the product in transaction reporting data and help assess systemic risk and detect market abuse.

The DSB has been designed to meet the particular requirements of the derivatives markets. These requirements include near-realtime allocation of ISINs upon application by a user. Its underlying technology platform handles multiple taxonomies of definitions and descriptive data for OTC derivatives. User can access the numbering services through either a web interface or direct integrations to users’ front-office systems for trading and order management.

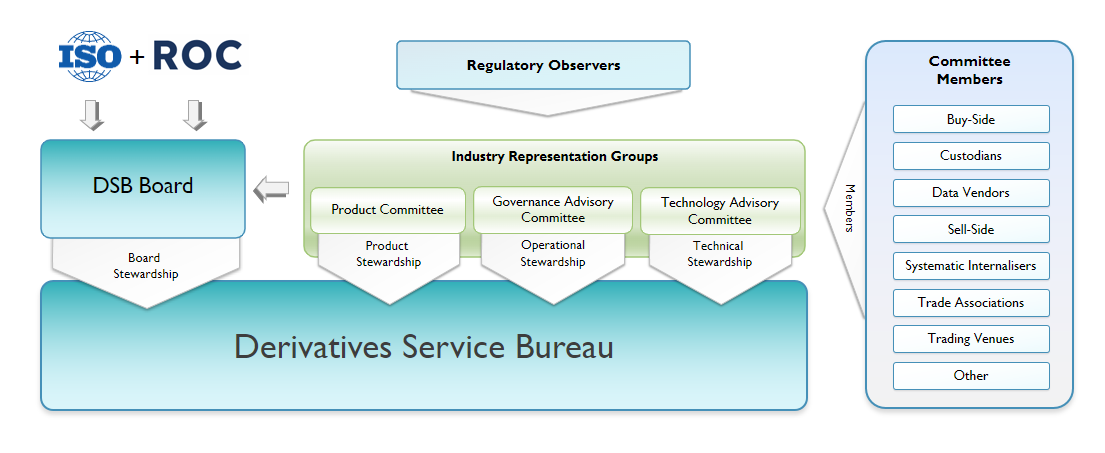

Established by ANNA as a subsidiary Special Purpose Vehicle, the DSB is governed by a board of directors. Reporting to the board is the industry-based Product Committee that determines the data definitions for ISINs across a broad range of derivative types, as well as maintaining the technical integrity of the ISIN. The structure of the DSB is illustrated in the graphic above.

The creation of the DSB was triggered by a decision in September 2015 by European regulators that ISIN would be the preferred identifier for new regulatory reporting mandates coming into effect, specifically MiFID II, MiFIR and MAR. These regulations would require ISIN-based reporting of certain OTC derivatives transactions for the first time.

The development timeline for the DSB was keyed to reporting requirement of MiFID II, which came into effect in early January 2018. At that time, industry implementation of the new automated global numbering agency began to support reporting of OTC derivatives.

Operational standards of the DSB derive from the business and technical requirements mandated by International Organization for Standards (ISO) on numbering agency operations. Oversight and enforcement is the responsibility of ANNA, which serves as the ISIN Registration Authority under contract with ISO. These ISO requirements include pricing of numbering agency services on a cost-recovery basis.

Further information about the development history and current initiatives can be found in the News section of this website.

More detailed information on the Product Committee which oversees the expansion of the ISIN to cover applicable derivative products, as well as maintaining the integrity of the standard.

More detailed information on the Product Committee which oversees the expansion of the ISIN to cover applicable derivative products, as well as maintaining the integrity of the standard.

During its development period, the DSB will conduct a series of open industry consultations to ensure that it meets the needs of participants in OTC derivatives markets. Here are links to the consultation pages where the downloadable consultation papers can be found, as well as industry responses and finalized papers.

The Derivatives Service Bureau (DSB) Limited is a company registered in England and Wales (No. 10542063)

LEI: 529900ORI6ALO8ABW676

Registered Address:

The Derivatives Service Bureau (DSB) Limited,

Randall House,

6 Dowgate Hill,

London, EC4R 2SU,

United Kingdom

© 2025 The Derivatives Service Bureau (DSB) Limited. All Rights Reserved.