The CFTC, SEC and DSB address key industry questions ahead of the go live of US UPI regulatory reporting

The launch of the UPI Service for OTC Derivatives on 16th October 2023 and the commencement of US UPI regulatory reporting on 29th January 2024 are the result of multi-year, cross industry and international efforts to develop a global automated identifier framework that best serves the OTC derivatives market. Following active collaboration and consultation processes involving regulators and all industry participants, data now shows that user readiness is in line with DSB expectations and the authorities expect a successful transition.

Just ahead of the US UPI regulatory reporting start date, Robert Stowsky, Commodity Futures Trading Commission (“CFTC”) Program Manager and Senior Data Analyst, Division of Data, and Justin Pica, Securities and Exchange Commission (“SEC”) Assistant Director, Division of Trading and Markets US, joined Emma Kalliomaki, MD DSB to discuss expectations and answer questions on the first G20 jurisdiction to go live for UPI regulatory reporting. The questions and responses are summarised below.

(Please note-all comments made are personal to the speakers and do not represent the views or opinions of others or their organisations. A full recording of the event can be accessed here)

1/What rules apply for UPI reporting?

Under SBSR there are two SEC rules relating to UPI:

- Rule 901(c)(1) – covering the reporting of primary trade information regarding Security Based Swaps including a product ID where one is available.

- Rule 901(h) which requires those with a duty to report information under SBSR transmit information to a Swap Data Repository (SDR) in the format required by the SEC.

- Rule 902(a) which requires an SDR to publicly disseminate SBS information including primary trade information, including UPI.

Since the UPI will be available via the DSB from 29th Jan 2024, firms are required to include UPI under the above rules.

From the CFTC perspective, the following CFTC regulations apply:

- 17 CFR 43 (“part 43”), which covers real-time public reporting of swap transactions and the public dissemination of swap transaction and pricing data in real time by SDRs for public transparency purposes; and

- 17 CFR 45 (“part 45”), which is specific to swap data recordkeeping and reporting requirements.

Prior to the designation of UPIs, the CFTC regulations provisionally mandate use of the internal product identifier or product description used by the SDR to which a swap is reported in all recordkeeping and swap data reporting pursuant to part 45. On February 16, 2023, the Commission issued an order designating the UPIs issued by the DSB for swaps in the credit, equity, foreign exchange, and interest rate asset classes as the UPI and product classification system to be used in recordkeeping and swap data reporting pursuant to the CFTC’s regulations.

2/What are the expectations for implementation?

The SEC and CFTC have been active in the development of the UPI and transaction reporting requirements. The aim and expectation for implementation is the harmonisation of the data that swap repositories and market participants are required to report across all swap markets.

The UPI will be a required data element for recordkeeping and data reporting starting on January 29th 2024 for all new and existing swaps.

3/What will UPI data be used for?

Identification of swaps using a UPI would enable the CFTC and the SEC to aggregate swap and security-based swap transaction data at various levels of product classification, providing enhanced transparency of market activity and facilitating oversight of the swaps and security-based swaps markets.

The UPI data will also be used for public price dissemination allowing for market analysis by non-regulators.

4/Who should be responsible for getting UPIs?

Given the single sided reporting regime in the US, it is the reporting party who has the obligation to obtain a UPI.

5/How do you request a UPI for products that may not ‘fit’ an available UPI product definition, but have a UPI regulatory reporting requirement?

The authorities and the DSB recognise that OTC derivative markets are constantly evolving. Best efforts have been made to have all appropriate templates in place, including a catch-all template, but if a product structure or underlier is not neatly covered, it can be referred for consideration to the DSB Product Committee by market participants and authorities.

6/Is there any scenario where one product will have multi UPIs

The UPI is designed to be ”unique.“ As such, there should be one UPI per product. .

If a scenario arises that needs interpretation or best practice guidance then the DSB Product Committee will work with stakeholders to resolve such situations.

7/What is best practice for non-reporting parties to obtain reporting data?

This depends on the level of capability of non-reporting parties. Some non-reporting entities may receive data from their swap dealer that has the reporting responsibility.

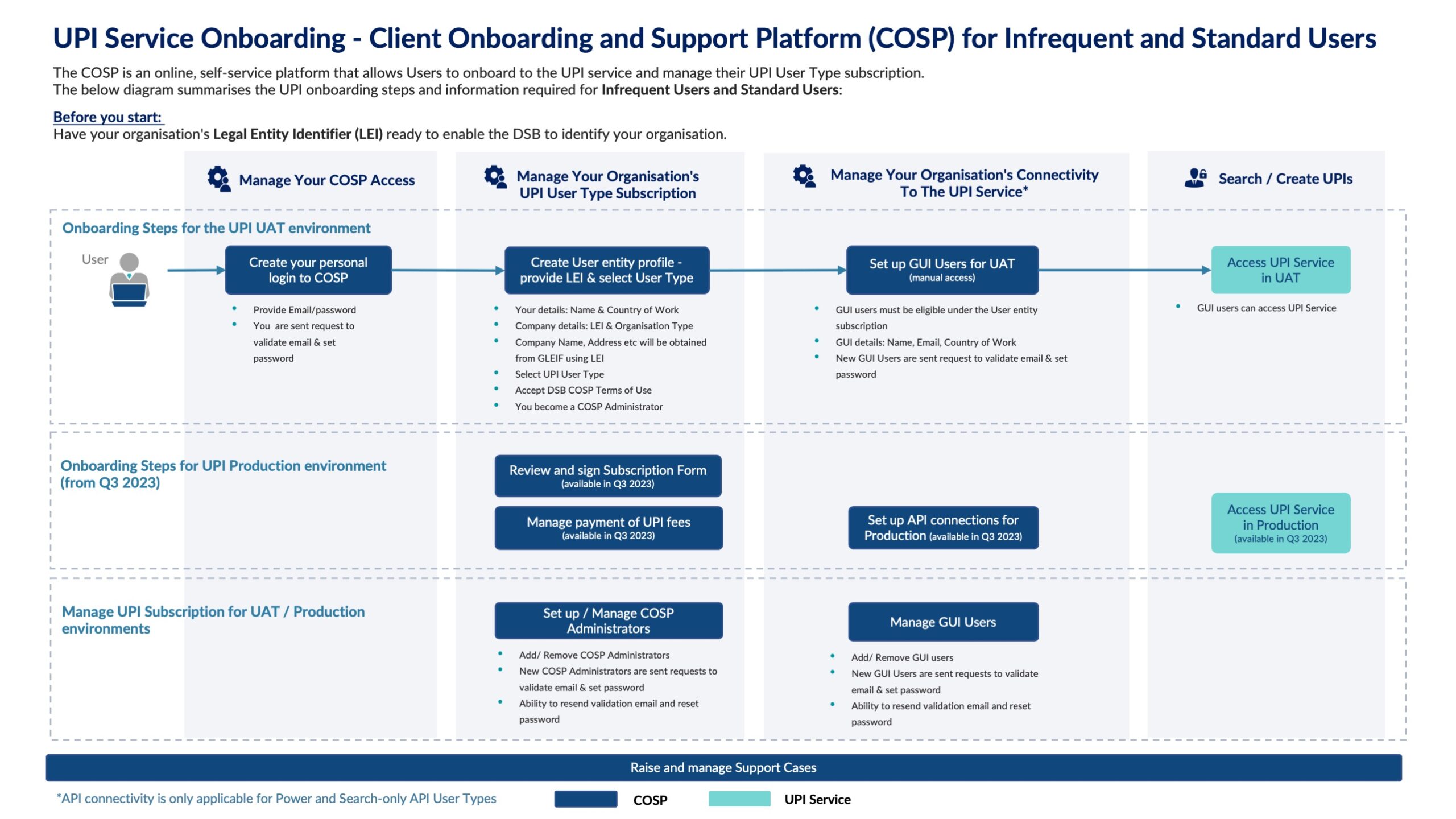

If not, the DSB has a simple user interface as well as file downloads where this data can be obtained.

For sophisticated non-reporting entities, data may be obtained directly through the programmatic interface offered by the DSB.

8/Where can I find out more information

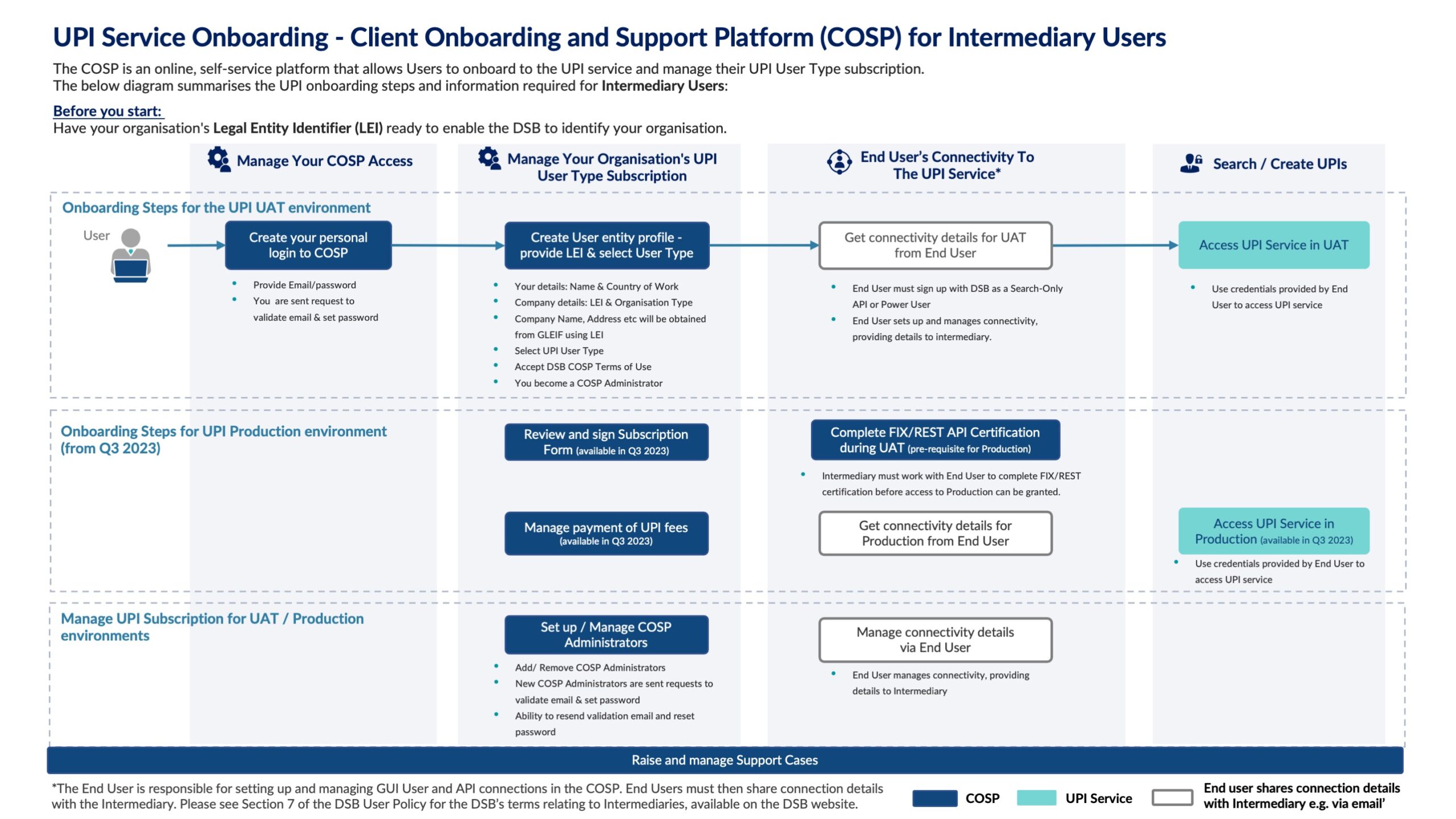

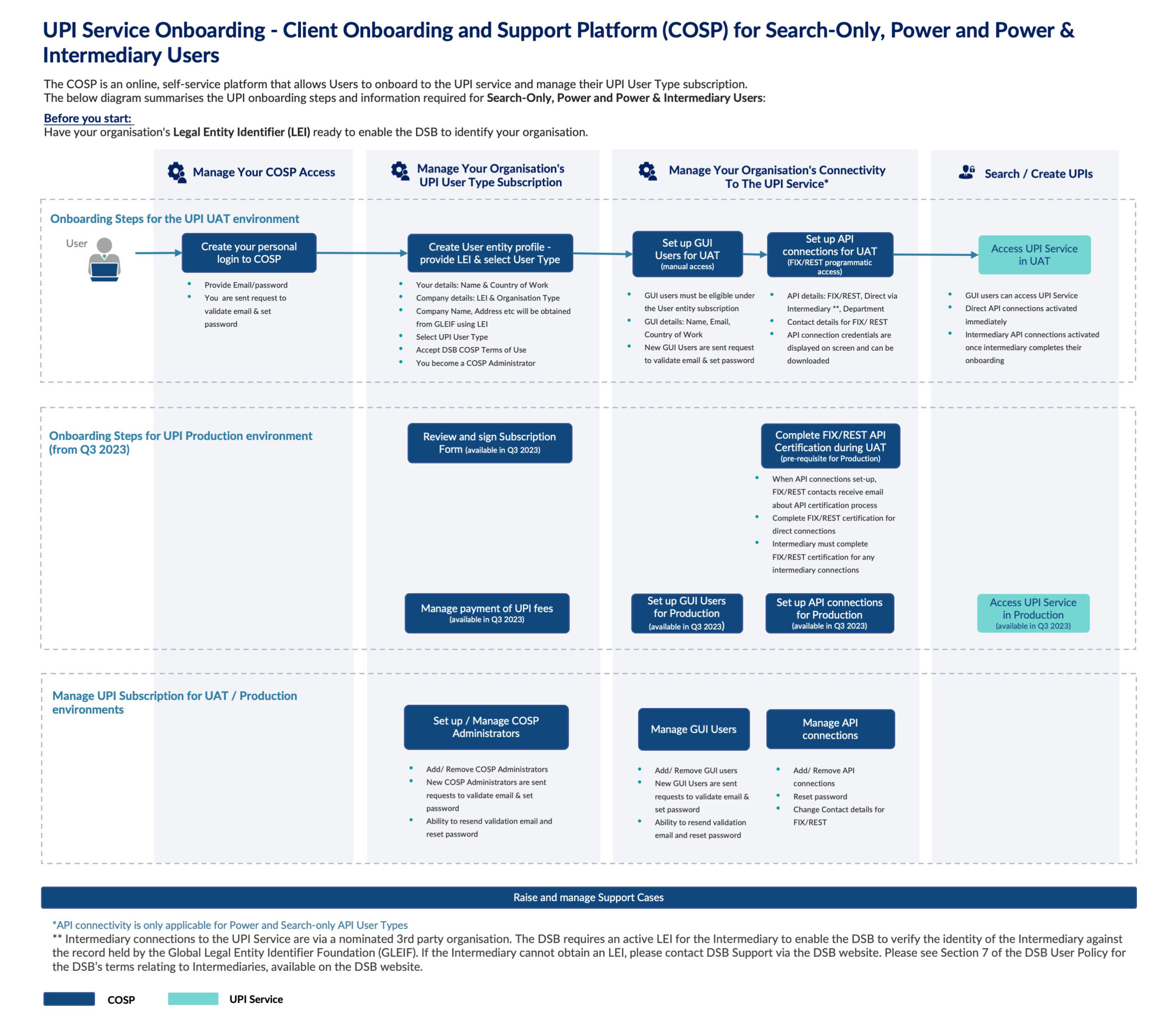

The DSB has a scalable onboarding solution enabling effective and timely onboarding with a variety of connectivity options.

There is a dedicated online support team available 24 hours 6.5 days a week to support users through the onboarding and for other queries they may have. More details can be found here.