The topic of whether and how the data elements contained within each of the CFI, UPI, and OTC ISIN will align is one that has arisen from time to time, and with increasing focus as UPI design and implementation starts to take centre stage. The DSB Product Committee has been evaluating this topic for some while as part of its broader considerations, and takes the following view on the matter:

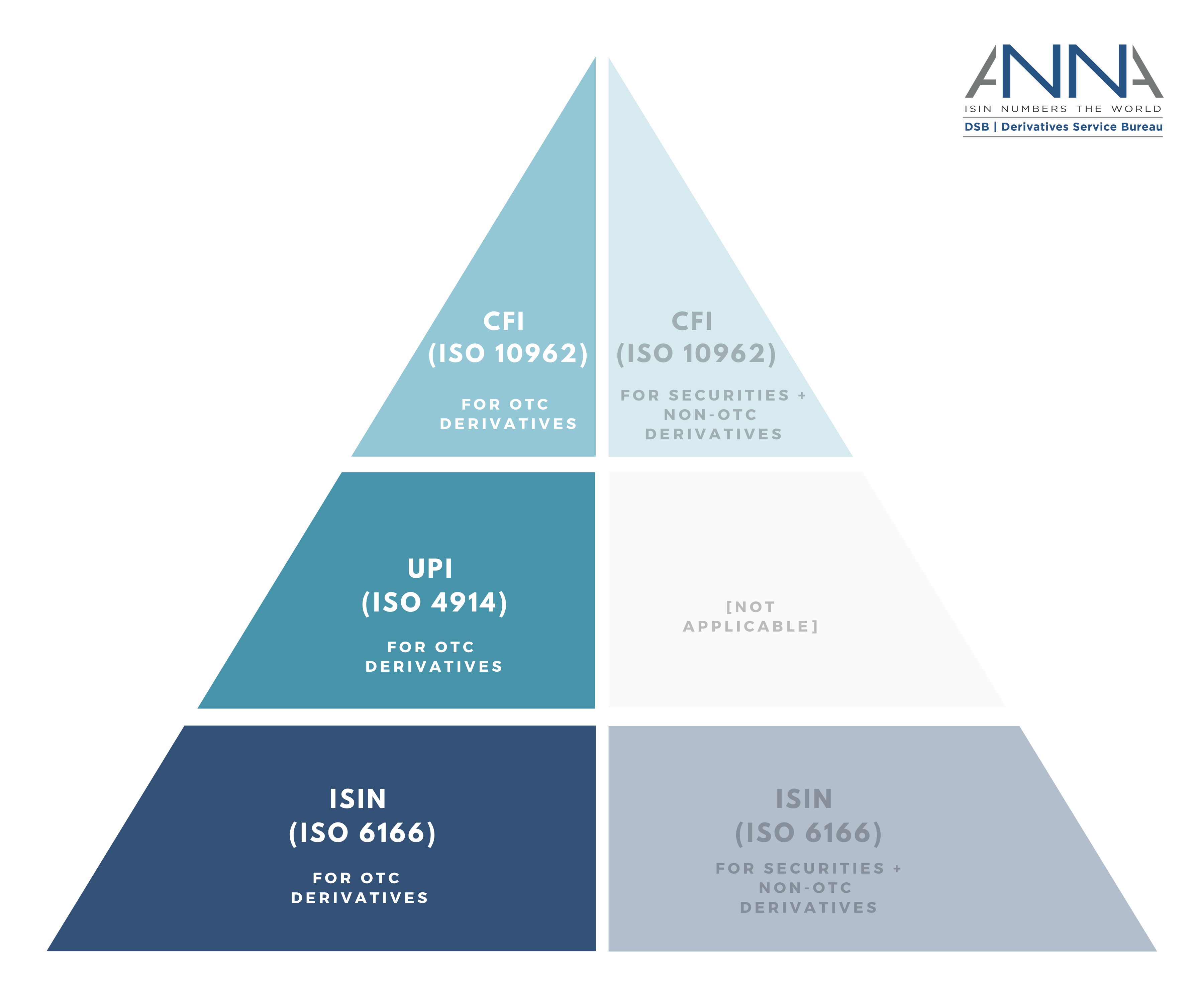

▪ The UPI, currently being developed as an ISO standard (ISO/WD 4914), will sit within the suite of ISO standards provided by the DSB as a product level identifier, reflecting a subset of the data elements required for OTC ISIN.

▪ This means the UPI is anticipated to sit between the CFI and OTC ISIN representing an identification framework for OTC derivatives.

The DSB is responsible for serving the needs of OTC derivatives market participants through the allocation and distribution of ISINs, the CFI code, and the FISN – all globally recognised and adopted ISO standards. Each standard has an individual purpose and complements each of the other standards. They are each respectively used for identifying, classifying and describing financial instruments.

The UPI, currently being developed as an ISO standard (ISO/WD 4914), will sit within the suite of ISO standards provided by the DSB as a product level identifier, reflecting a subset of the data elements required for OTC ISIN. This means the UPI is anticipated to sit between the CFI and OTC ISIN representing an identification framework for OTC derivatives.

The UPI must be fully consistent with the principles set out in the UPI Technical Guidance, which sets out technical requirements for a UPI Code and related reference data, and any further guidance provided by Committee on Payments and Market Infrastructures together with the International Organization of Securities Commissions (CPMI-IOSCO), or the Financial Stability Board (FSB).

The core assumption is that the data elements contained in each of the CFI, UPI, and ISIN will remain aligned.

The PC will work with the International Governance Body (IGB) to resolve any concerns with respect to alignment of the CFI, UPI and OTC ISIN.

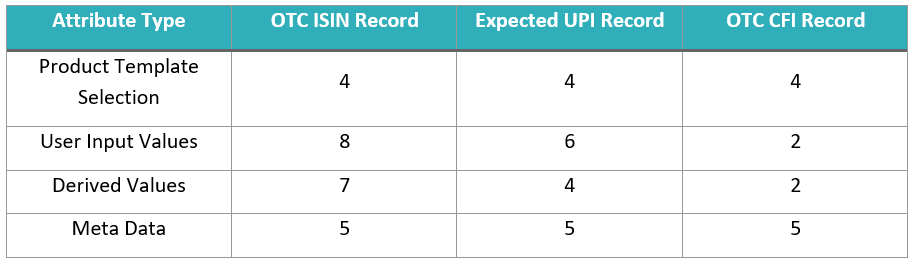

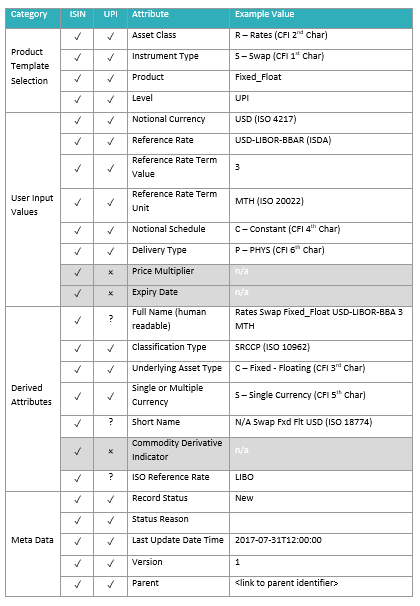

To put the information presented above within the context of the attributes required to define an OTC derivative, an example of the expected OTC ISIN to UPI mapping is presented below. The structure in the tables below is based on the UPI Technical Guidance document published by CPMI-IOSCO in September 2017.

For a single currency fixed-float Interest Rate Swap:

- The OTC ISIN Record is a superset of the UPI Record

- The UPI contains two fewer attributes to uniquely define the Record

- The DSB can derive additional useful information for both regulators and industry

- The DSB Record contains additional meta data that tracks version, status and other administrative information

As a reminder, the DSB offers CFI and OTC ISIN creation and search services today, with UPI services under development and expected to come online in the second half of 2022, to dovetail with regulatory expectations published in September 2019.

As ever, questions are welcome and can be directed to otc.data@anna-dsb.com.

Published by: Malavika Solanki