ESMA Q&A published in September 2018 provided guidance on a number of matters, including a view on how RTS-23.Field34 (Delivery Type) was to be populated in order to ensure more consistent reporting for Interest Rate Swaps. Specifically, the Q&A noted that:

- “The value P – Physical is to be used when an interest rate swap is Deliverable where Deliverable means that the settlement, i.e. payment, currency amounts are paid in the respective reference currency for each leg of the swap for which the payments are being made.

- The value C – Cash is to be used when an interest rate swap is Non-Deliverable where Non-Deliverable means that the settlement, i.e. payment, currency amounts are paid in a currency other than the respective reference currency for each leg of the swap for which the payments are being made.”

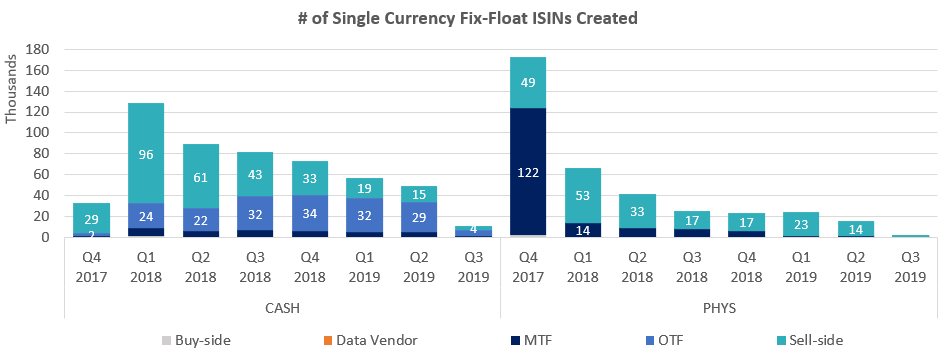

Members of the DSB Product Committee sought to review and understand whether and how users had altered the creation of OTC ISINs to align with ESMA’s guidance, almost a year after the ESMA update.

The analysis showed trends that were contrary to the ESMA guidance and the industry’s subsequent expectation as a large population of OTC IRD users are continuing to create OTC ISINs with a delivery type of “Cash” for interest rate swaps where the currency amounts are paid in the reference currency.

The analysis of Delivery Type for single currency Fixed-Float IRS (the most commonly traded OTC IRD instrument) showed that most MTFs and the sell-side were creating OTC ISINs with a mix of Cash and Physical Delivery Types (indicating at least partial compliance with the ESMA guidance), while most OTFs largely continued to create OTC ISINs using only Cash as Delivery Type (indicating a lack of compliance with the ESMA guidance).

Need for action: The PC noted that the DSB should publish a blog to make users aware of the need to pay increased attention to the way in which they create OTC IRD ISINs and also engage trade associations that are not DSB PC participants, asking them to communicate the information to members.