First round of industry consultation on fee model principles now open

London, 12th December 2021 – The Derivatives Service Bureau (DSB), founded by the Association of National Numbering Agencies (ANNA), to facilitate the allocation and maintenance of ISINs, CFIs and FISNs for OTC derivatives, is today calling on industry to respond to a first consultation on the fee model principles underpinning the Unique Product Identifier (UPI) service, which opened this week.

The DSB urges market participants required to report to trade repositories anywhere in the world, and will be mandated to incorporate the UPI into their workflows, to review and respond to the consultation, so that a broad spectrum of views can be reflected in the service that is introduced in 2022. Because such firms will need to access, integrate, create, and consume UPI data, the DSB is actively encouraging industry to participate in shaping the service.

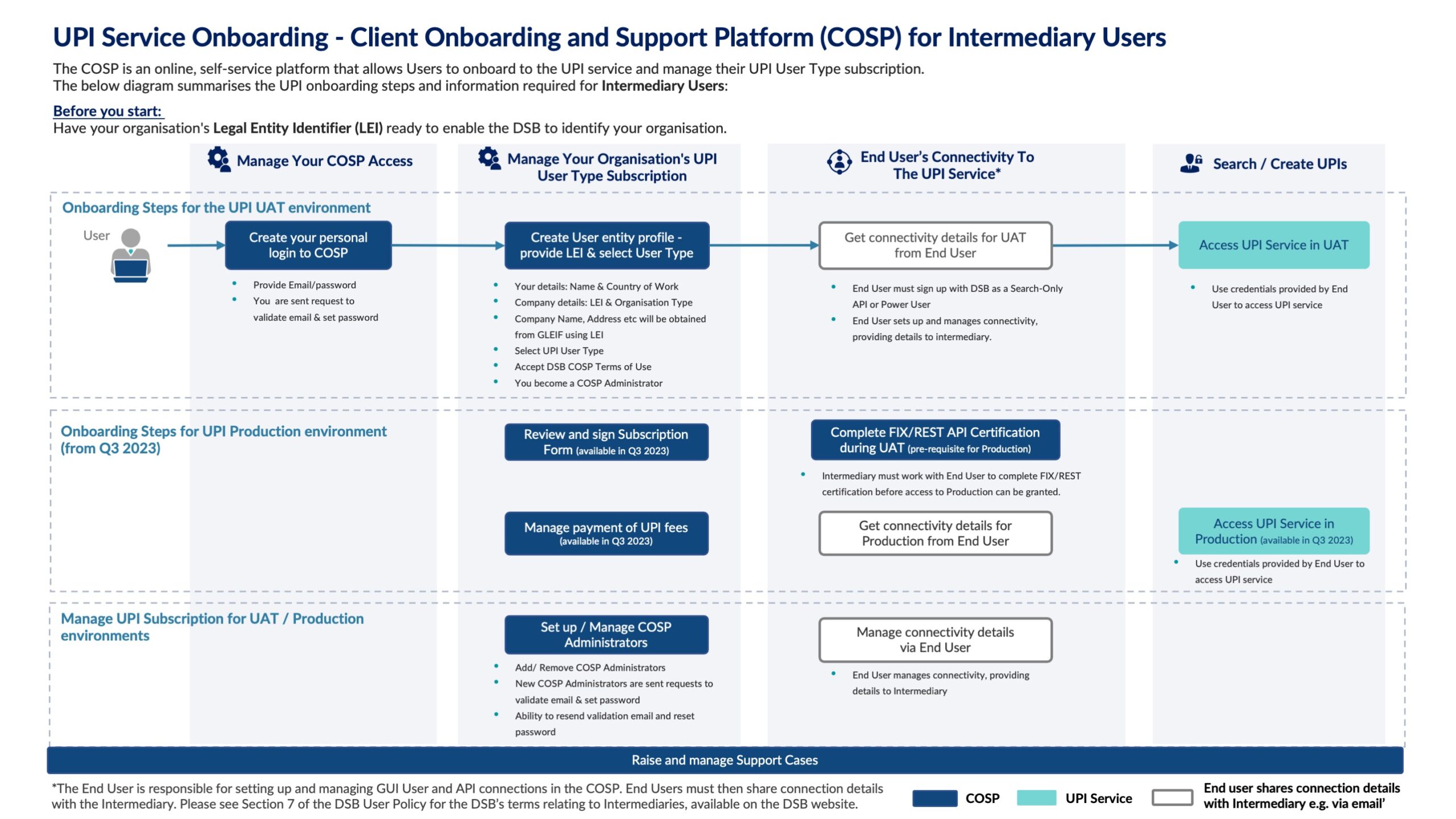

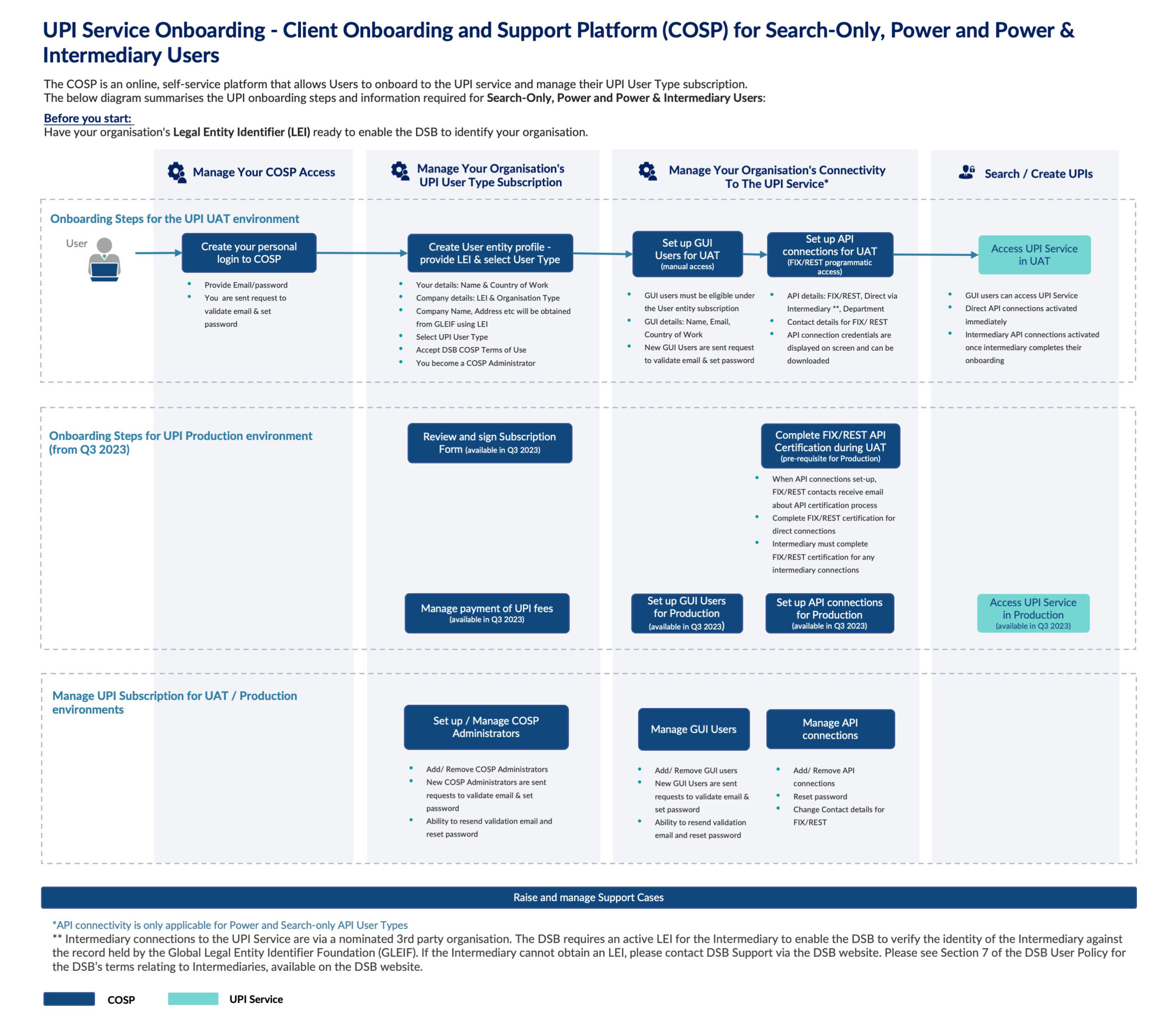

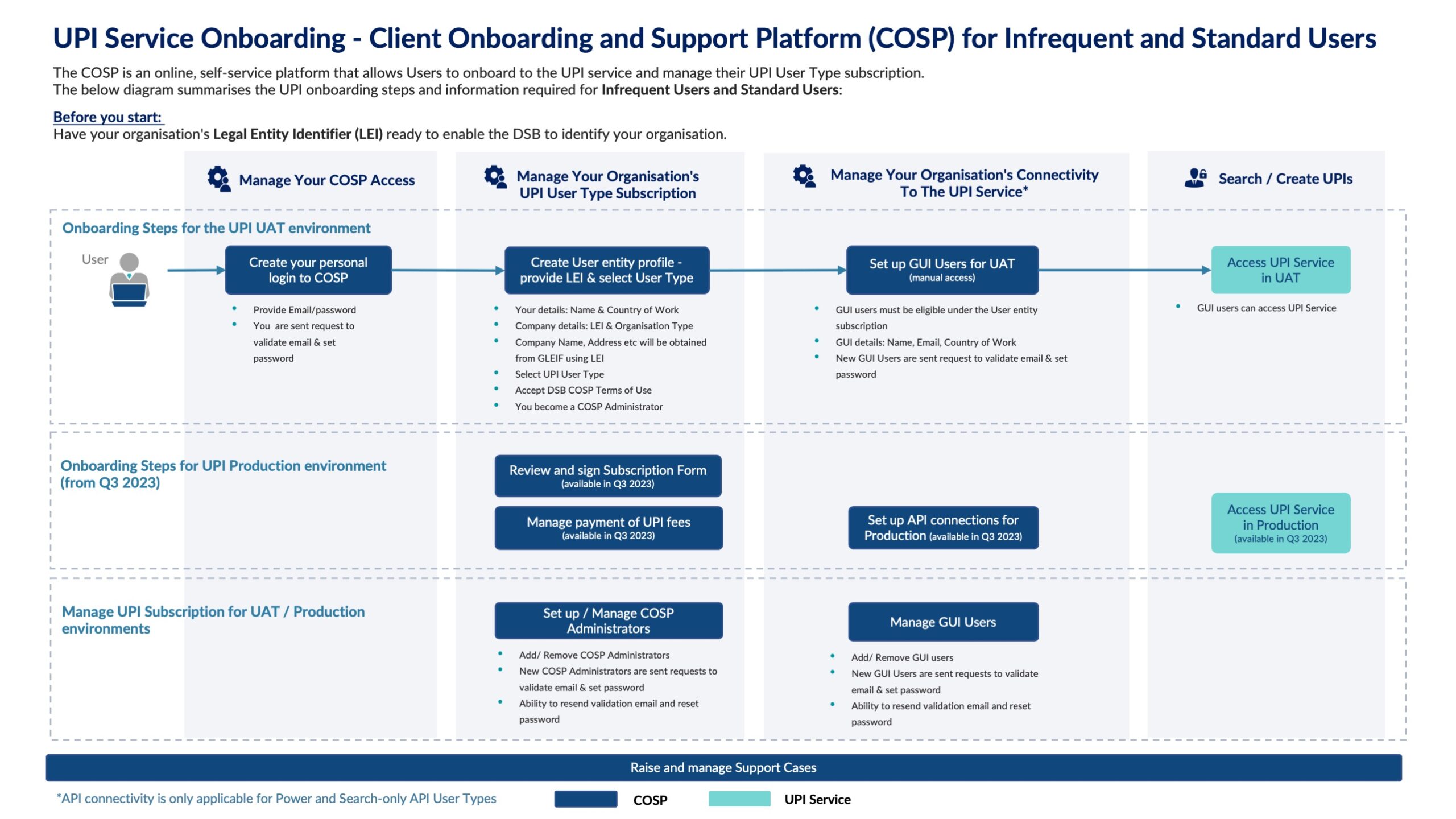

The consultation will examine topics such as expectations around UPI adoption and the estimated number of users, the types of users, the use of workflows, cost allocation processes, duration of the initial user agreements, the proposed invoicing methodology and more. The UPI goes beyond the existing DSB service, as the scope of the UPI is expected to be much broader than the scope of regulations currently addressed by the DSB’s OTC ISIN service. There will, therefore, also be new users of the UPI who may not be as familiar with the DSB’s processes. The DSB encourages all such firms to get involved at the earliest opportunity in the consultation.

The outcome of the consultation will be fundamental to laying the groundwork for how the UPI service and its fee model will be structured once it goes live. The consultation process will also help shape how to set fees, who they are applicable to, and the related functionality for the variety of anticipated UPI users.

Emma Kalliomaki, Managing Director of ANNA and the DSB, said, “UPIs will have a global footprint, and so we are looking to obtain the broadest range of views in response to our consultation process. Although the service is not being introduced until 2022, now is the time for industry to get involved in the preparations so that we cater for the widest range of interests when shaping the UPI service for stakeholders.”

Malavika Solanki, a member of the DSB Management Team, said, “The DSB has already been collaborating with industry participants through the DSB Product Committee and the Technology Advisory Committee to leverage as much of the existing infrastructure and architecture as feasible, while recognizing the unique needs of the UPI service. The DSB has been in close communication with a range of market actors to ensure that the UPI service meets the needs of our stakeholders. If your institution reports to a trade repository, we would like to hear from you, as we wish to gather views from institutions of all sizes.”

In 2019, the FSB announced its decision to designate the DSB as the sole service provider for the future UPI system, performing the function of issuer of UPIs as well as operator of the UPI reference data library. For more information please do visit our website on UPI. The first consultation ends March 5th, 2021. The second Industry Consultation starts May 10th and ends July 9th. With the publication of the Final Consultation paper September 9th, 2021.

ENDS

Media contact for the DSB

Lindsay Clarke

Streets Consulting

+44 (0)20 7959 2235

lindsay.clarke@streetsconsulting.com

The Derivatives Service Bureau (DSB) Ltd

The Derivatives Service Bureau is a global numbering agency for OTC derivatives serving the needs of market participants through the allocation of International Securities Identification Numbers (ISINs), the Classification of Financial Instruments (CFI) and Financial Instrument Short Name (FISN), all globally recognised and adopted ISO standards for identifying, classifying and describing financial instruments.

The DSB has also been designated as the sole provider of the Unique Product Identifier (UPI) by the Financial Stability Board (FSB) and is working with stakeholders to make the UPI globally available.

Serving almost 500 institutions (70% free of cost), with an underlying technology platform that is built to support multiple taxonomies of definitions and descriptive data, as well as numbering in near-real-time, the DSB is motivated to bring greater transparency and integration within the OTC derivatives market, enabling institutional investors to standardise data and better control operational risk. Users can access the DSB through a web interface, by accessing data in daily update files or by direct integration to front-office systems for trading and order management.

The DSB is a legal subsidiary of the Association of National Numbering Agencies (ANNA). With widespread industry representation, expertise and collaboration at its core, the DSB’s history, pedigree and expertise are rooted in ANNA, with its broad experience and overview of handling both on and off-exchange ISINs for all asset classes. If you would like to use the Derivatives Service Bureau please visit the DSB website.

About ANNA

The Association of National Numbering Agencies (ANNA) is a global member association seeking to foster standardisation within the financial industry by upholding the International Organization for Standardization (ISO) principles and by promoting ISIN, FISN and CFI codes for financial instruments. This is achieved through ongoing, collaborative work with market participants, regulators and other standards bodies.

Under ANNA’s stewardship, the role of the ISIN in enabling global financial communications has been established worldwide. Founded in 1992 by 22 numbering agencies, today ANNA’s membership continues to grow, with more than 120 global members and partners allocating ISIN, FISN and CFI codes on behalf of their local jurisdictions. By putting in place rigorous governance around the development, allocation and sharing of ISIN, FISN and CFI codes, ANNA helps facilitate open, transparent markets diminishing barriers to access, while protecting the integrity of the standards. As a result, ISIN has become the recognised global standard for unique identification for all types of financial and referential instruments, helping to connect and protect global markets.

In addition, ANNA has established the Derivatives Service Bureau (DSB), a fully automated global numbering agency to meet the specific operational and regulatory requirements of the over-the-counter derivatives markets.

For information about ANNA, its members and activities, please visit the website